June 19. 2024. – 12:27 PM

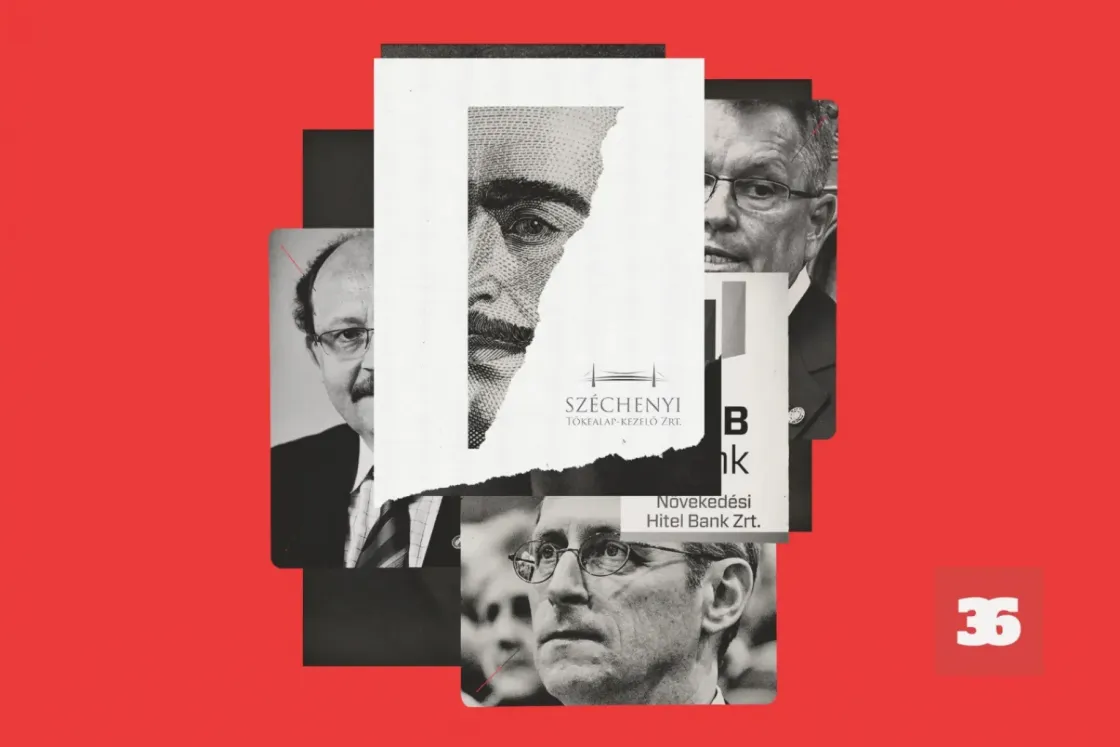

A memo with an ominous tone was prepared for Finance Minister Mihály Varga in the first half of 2020. The subject of the three-and-a-half-page document, written by State Secretary Balázs Rákossy, was Széchenyi Funds (SZTA), a fund manager company under the Ministry of Finance at the time, which requested urgent financial assistance.

The company had lost nearly 7 billion forints, and this event put its whole operation in jeopardy.

SZTA got into trouble because in 2018 they placed a significant amount of taxpayers’ money entrusted to them as a bank deposit in the Növekedési Hitel Bank (NHB). This is the financial institution that belonged to the cousin of the president of the Hungarian central bank, György Matolcsy, and which went into liquidation in 2019 after it had given loans to various business circles close to the government and had run into a series of liquidity problems.

SZTA’s deposits, worth nearly 7 billion forints, got stuck in the bank which is still under liquidation. In 2019, 24.hu already reported that the company was one of the victims of NHB’s collapse, but Direkt36 has now obtained internal documents that provide a much more detailed story of the event that caused serious losses to the state – and thus to tax-paying citizens:

- According to the documents, SZTA deposited billions with NHB after the bank had been repeatedly fined and warned by the authorities.

- The subsequent internal investigations concluded that the head of SZTA, Imre V. Csuhaj, currently working as a consultant to György Matolcsy, had decided on these transactions in violation of internal rules.

- Csuhaj was already connected to Matolcsy’s circles at the time of the transactions, as he held positions in several organizations and companies related to the central bank.

- The problem of SZTA was dealt with at the highest level in the Ministry of Finance, and the Minister of Finance, Mihály Varga was also involved in the settlement of the case. In the end, the ministry carried out a 20 billion forints capital increase at the company from taxpayers’ money with the apparent goal to avoid any irregularities at SZTA.

- Due to the lost billions, the police have launched an investigation during which they have not interrogated anyone as a suspect so far.

With this story, we can get an even more complete picture of the operation of SZTA, which is now under the supervision of a university foundation. The company had not had a high profile previously but Direkt36 has revealed how SZTA participated in the financing of several key projects for the Orbán government. Last fall, we reported that the fund manager secretly contributed more than 70 billion forints in capital increase to the government-linked company called 4iG. And in April this year, we revealed that SZTA provided significant funds for the purchase of the international television channel called Euronews to a Portuguese businessman whose father had been friends with Viktor Orbán for decades.

To our questions SZTA said that “our company has taken all steps permitted by law in order to get back the deposited money”. They added that “as a result of this, we have now achieved a significant return”, but they did not answer the question on what this means specifically. At the same time, it became clear from their answer that they are still chasing part of the money. “In order to enforce our demands related to the case, our company also initiated additional civil lawsuits, which are currently ongoing and after the conclusion of these lawsuits, our return can be complete,” the company wrote.

Although we contacted Imre V. Csuhaj multiple times before publication and sent him a detailed set of questions, he only responded after the article was published. In his response, he emphasized that all claims suggesting he violated any laws or internal regulations when placing the deposits are false.

Responsibilities

The story began with a resounding plan. In the summer of 2018, SZTA announced the launch of the Nemzeti Tőzsdefejlesztési Alap (National Stock Exchange Development Fund) with the aim of facilitating the stock market entry of small and medium-sized companies. The fund had a budget of 13 billion forints, which the Ministry of Finance provided for SZTA. The role of SZTA as the fund manager was to invest this money in a way that met the fund’s objectives (i.e., to assist companies in going public) and to generate returns for the investors, ultimately the Hungarian taxpayers.

“The SZTA is anticipated to be an active participant in the stock market appearance of companies as early as this year,” SZTA wrote in a summer 2018 blog post, highlighting the fund’s “attractive” features.

However, instead of a success story, the project quickly turned into a colossal failure. Just months after the fund’s launch, a series of decisions led to the loss of billions.

According to internal documents obtained by Direkt36, all of the 13 billion forints received from the Ministry of Finance were first transferred to SZTA’s account at OTP Bank in June 2018. However, a few weeks later, in early August, the company decided to transfer half of the money, 6.5 billion forints, to Növekedési Hitel Bank (NHB), where it was then placed in various term deposits. In other words, they committed not to touch the money for a certain period and allowed the bank to manage it.

Soon after, they decided to transfer even more money to NHB. On August 17, they released the 6 billion forints remaining at OTP Bank and later placed further deposits at NHB.

Despite it being evident that there were problems with NHB, SZTA continued to transfer increasingly larger amounts to the bank. On July 25, 2018, two weeks before the first term deposit, the Hungarian central bank imposed a 3.9 million forint fine on NHB for failing to fulfill their data reporting obligations.

A few weeks later, it became clear that issues at the bank were far more serious than data reporting. On August 14, the central bank issued a decision imposing a 19 million forint fine on NHB for various deficiencies. The decision detailed on five pages what the bank needed to rectify for proper operation.

These warnings and fines did not deter SZTA from committing even more to NHB. According to the leaked documents, in September, October, and November 2018, they placed a total of approximately 5 billion forints in deposits at the bank.

Meanwhile, despite the fines and warnings, things did not improve at NHB. The situation was deemed so serious by the Hungarian central bank that in December 2018, a supervisory commissioner was appointed to the bank, who limited the withdrawal of deposits that can be withdrawn within thirty days to HUF 7 million. This meant that larger amounts could not be withdrawn from the NHB, leaving billions of taxpayer forints managed by SZTA stuck in the bank.

Family businesses

The supervisory measures imposed on the bank at the time caused a significant stir, as NHB had strong political connections.

Since 2013, the financial institution had been owned by Tamás Béla Szemerey, a cousin of György Matolcsy, the former Minister of National Economy and current president of the Hungarian central bank (MNB). For years, NHB handled businesses linked to the Matolcsy family and to MNB. In 2014, the Pallas Athéné Foundations, established by MNB, deposited a large portion of the state billions they received at NHB (under very unfavorable conditions, according to a previous article by Népszava).

In 2016, 444 reported that NHB was part of the central bank’s so-called growth loan program. This meant that the central bank first lent to banks, which then lent to businesses. According to the site, NHB mainly used this program to finance companies linked to its owner Szemerey and his relatives.

The Matolcsy family also frequently utilized the financial assistance of their relative’s bank. In 2015, Ádám Matolcsy, one of the sons of the president of the central bank purchased the Balaton Bútor furniture company with a loan from NHB, and according to previous articles by 24.hu, NHB also provided a 280 million forint mortgage loan for the luxury villa in the II. district of Budapest, where he and his father lived. According to a 2018 article by 24.hu, the villa on Kondor Street, adjacent to the property, was bought by Matolcsy’s other son, Máté, with the help of a 90 million forint NHB mortgage loan.

CEO from Matolcsy's circles

As later decisions by MNB revealed, NHB was operating irregularly during this time, and thus did not handle the deposited funds with the diligence expected of financial institutions. One of NHB’s largest depositors was SZTA, whose CEO at the time, Imre V. Csuhaj, also had several connections to György Matolcsy and his circle.

Csuhaj became a board member of several Pallas Athéné Foundations, which were established and endowed with substantial assets by MNB during Matolcsy’s presidency. Additionally, since 2015, he participated in the management of Kecskeméti Duális Oktatási Központ (KEDO) Ltd., created to develop the Neumann János University in Kecskemét, an initiative closely associated with Matolcsy and MNB.

Direkt 36 has contacted Csuhaj, who is currently serving as the chief advisor to Matolcsy at MNB multiple times, but he has declined to answer questions. He did not address why he decided to deposit funds in NHB or whether his relationship with Matolcsy influenced this decision.

Among the internal documents obtained by Direkt36, there is one that reveals Csuhaj’s version of the events. In a March 2019 board presentation prepared by Csuhaj, it was stated that they engaged with NHB because SZTA aimed to “support majority Hungarian-owned banks in line with the government’s strategy.” Previously, they had cooperated with OTP, MKB, and Gránit Bank, and later included NHB in this circle.

According to the presentation, they did not consider it risky to transfer money to NHB because the bank did not indicate any issues with repayment.

“There were no complaints about the bank’s services, and the companies’ contacts did not indicate that there could be any problems with the planned reallocation of the deposited funds,” the document states, adding that “the interest conditions offered by NHB Bank Ltd. were favorable but not outstanding compared to the market.”

Csuhaj also explained why they were not alarmed by MNB’s August 2018 fine imposed on NHB for various irregularities. “This was not an extraordinary occurrence in itself, as other banks were also fined similarly during this period based on publicly available information,” the presentation noted, emphasizing that MNB’s statement included that “the identified violations do not pose a systemic risk and do not endanger the reliable operation of the bank.” (Indeed, the central bank’s press release contained this sentence, but it also mentioned that “the central bank considered the numerous violations with high or significant risk ratings an aggravating factor.”)

In the presentation, Csuhaj did not elaborate on why they made further deposits at NHB even after the fine was announced. However, he emphasized that they tried to reduce their exposure to the bank at the end of 2018. He stated that on December 7, 2018, they “reallocated 1.4 billion forints, which were placed with OTP Bank Nyrt.,” essentially returning the money to the bank where it was originally held.

The presentation indicated that they planned to continue withdrawing the funds, but they were no longer able to do so. On December 18, MNB announced the appointment of a supervisory commissioner and restricted depositors to withdrawing a maximum of 7 million forints every 30 days.

This severely impacted SZTA. Since MNB’s restriction only applied to deposits, they could transfer 2 billion forints held in stocks to OTP, but 6.8 billion forints in deposits remained stuck. (It did not help the big picture that Csuhaj emphasized in the presentation that they took advantage of the opportunity and withdrew 7 million forints from NHB in December.)

In the document written in early March 2019, Csuhaj discussed the planned schedule for withdrawing the remaining funds. However, it soon became clear that this would not be possible. On March 14, MNB announced the revocation of NHB’s license and ordered its liquidation. This meant that the liquidation process would determine when and to what extent depositors would have access to their money.

Leadership responsibility

Csuhaj did not remain at SZTA for long; his tenure as CEO ended in April. The subsequent leadership of SZTA continued to investigate the circumstances surrounding the missing billions, and the resulting investigations revealed that Csuhaj’s responsibility was greater than he had portrayed in his presentation.

Among the documents obtained by Direkt36 is a memo prepared by the Oppenheim Law Firm on behalf of SZTA concerning the NHB case. The firm examined the potential legal claims that could be enforced and concluded that it might be justified to take action against Csuhaj, among others.

“We consider the claim against the CEO based on the breach of executive obligations to be well-founded,” the legal memo states, noting that the breach of obligations is especially likely in relation to the funds deposited in NHB after MNB issued its decision on the identified problems at the bank.

According to the law firm’s investigation, Csuhaj breached his obligations when he moved large deposits from OTP, the country’s largest bank, to the much smaller NHB in exchange for a slight interest advantage.

“In our opinion, all deposits made in NHB represent a breach of the executive obligations stemming from the executive responsibilities, regardless of the MNB decision,” the memo states.

The law firm examined the internal rules of SZTA and established that Csuhaj did not have the authority to make such decisions alone; the decision was within the purview of the board of directors. “However, the other members of the board were not aware of this and did not participate in the decision-making process in any way. Therefore, the lack of propriety of the decision solely raises the executive responsibility of the CEO,” the document states.

The legal memo also mentions that on February 17, 2020, the fund manager filed a complaint with the prosecutor’s office against an unknown perpetrator on suspicion of embezzlement. “We are not aware that the CEO has been questioned as a witness or a suspect during the criminal proceedings,” the document states. As it turned out, there have been no significant developments since then. The Budapest police headquarters, which is investigating the case, informed Direkt36 that “the case is still ongoing, no suspect interrogation has taken place.”

The minister intervenes

The internal documents reveal that as the situation worsened, the Ministry of Finance, which had originally entrusted the company with the lost funds and held the ownership rights of SZTA, became increasingly active.

According to Csuhaj’s presentation, he informed the ministry leadership of the situation the day after the central bank imposed restrictions on NHB, on December 19, 2018. As Csuhaj stated, he informed “State Secretary Balázs Rákossy verbally and Minister Mihály Varga in writing through Chief of Cabinet Csaba Havasi.”

Csuhaj then negotiated with the NHB leadership, which requested that if larger sums could be withdrawn from the bank again, SZTA should schedule their withdrawal for a longer period. The presentation noted that because the fund managed by SZTA was “the largest depositor, the future of the bank largely depended on its actions.” In other words, NHB feared that if SZTA were to withdraw its money quickly, the bank would face even greater difficulties.

Csuhaj informed the ministry about these negotiations, which, according to the presentation, responded that no agreement should be made with NHB without the approval of the ministry’s leadership.

On January 17, State Secretary Balázs Rákossy indicated that any agreement with NHB Bank must be preceded by the decision of the Minister,” Csuhaj’s presentation stated.

The documents suggest that the ministry was sympathetic towards NHB. SZTA had devised a plan for how it would withdraw its money from the bank, proposing that they keep their funds in the bank for up to two more years. However, according to Csuhaj’s presentation, “at the request of State Secretary Balázs Rákossy, the Fund Manager developed a schedule for a longer term” compared to the previous one. This plan involved extending the repayment period to over two years, until July 2021.

The presentation also noted that Rákossy stipulated again that “any agreement can only be signed if he, approves it, on the Minister’s decision.” However, such an agreement was ultimately unnecessary because the central bank’s decision on March 14, 2019, to liquidate NHB made any agreement futile.

From that point on, both SZTA and the Finance Ministry could only hope that they would recover their money during the liquidation process. However, the liquidation turned into insolvency proceedings, indicating that the bank did not have enough funds to pay all its creditors. (This process is still ongoing according to the company register. We contacted the company handling the insolvency, but they did not provide specifics on the status of the process.)

For the ministry, the next challenge was how to replenish the money lost by SZTA, which the ministry had originally provided with the condition that it would be repaid. State Secretary Balázs Rákossy wrote a dire memo to Minister Mihály Varga, warning that if no solution was found, it would lead to a legal violation. If SZTA did not receive funding, he cautioned, “the equity would fall below the registered capital, which does not comply with legal requirements.”

The leaked documents indicate lengthy discussions on how to resolve the issue. SZTA’s publicly available 2020 report eventually revealed the ministry’s solution. After summarizing the NHB investments and the resulting damages, the report notes that “in August 2020, the company’s founder decided on a significant capital increase totaling 20 billion forints.”

In other words, to address the problem of the nearly 7 billion forint loss suffered by SZTA, the company received an additional 20 billion forints of taxpayers’ money. We sent detailed questions to the Finance Ministry regarding the matter, but they only replied that “the Ministry of Finance always acts in accordance with the relevant laws.”

This article is part of a partnership between Telex and Hungarian investigative journalism center Direkt36.